BPJS Employment – The government has changed the old service, namely Social Security to Employment BPJS. In general, there is no difference between the two social services. It is because the government only wants to give the best for the entire community which is an employee and an entrepreneur. Since it was ratified three years ago, the Employment BPJS has succeeded in getting 27.3 million registrants and the desired target is 29 million until the end of this year.

The transition from Social Security to Employment BPJS made most of the rules in it also changed. However, not all cardholders know about it. In fact, as the owner of BPJSTK, you also have to be able to know how much Employment BPJS contributions are often paid each month. And it turns out, the payment of contributions is not fully borne by the company because there are some parts that you have to pay for yourself using personal money.

Read More : The Explanation of Bill Payment and Its Explanations

Employment BPJS Services

So far, there are four Employment BPJS services available to Indonesian citizens, namely Old-Age Insurance (JHT), Work Accident Insurance (JKK), Pension Insurance (JP) and Life Insurance (JKM). If you want to know more about the four services, please click here.

Within these four services, BPJS differentiates payments into two parties, namely companies and individuals. In other words, you also pay Employment BPJS according to the applicable provisions.

Work Accident Insurance (JKK)

Work Accident Insurance is fully paid by the company and will usually be reviewed by the central government once every two years regarding the amount. So, how much do companies have to pay each month for JKK? the answer depends on the level of risk of the work itself.

– Group 1 (very low risk) = 0.24% of monthly salary.

– Group 2 (low risk) = 0.54% of monthly salary.

– Group 3 (moderate risk) = 0.89% of monthly salary.

– Group 4 (high risk) = 1.27% of monthly salary.

– Group 5 (very high risk) = 1.74% of monthly salary.

Hence, which group do you belong to?

Death Guarantee (JKM)

Just like the Work Accident Insurance that is borne by the company, the Death Guarantee is paid by them. The difference is that the amount to be borne by JKM is 0.30% of the total salary each month. Evaluations are conducted every two years per minimum salary rates in each region.

Old-Age Insurance (JHT)

Different from JKM and JKK, the old-age insurance is borne by both parties, both the company and the individual salary of the Employment BPJS cardholder. Regarding the total amount of 5.7% per month, the company bears an expense of 3.7% while the rest is paid through employee salaries every month.

Read More : Proof Payment Definition and Examples

Pension Insurance (JP)

Similar to the Old-Age Insurance that is borne by both parties, the Old Age Guarantee is also borne by both parties. The company must pay 2% while the remaining 1% is borne by the employees. Thus, every month JP is charged at 3% of the total salary.

How to Calculate Employment BPJS Fees

Calculating Employment BPJS contributions is not complicated. Most importantly, you must know some important aspects below first, namely:

– Salaries of Employment BPJS cardholders.

– Minimum wages for work in an area to be calculated.

– The highest salary limit for Employment BPJS contributions is IDR 8 Million (subject to change).

– The penalty of 2% if the payment has not been made until the 15th of every month.

– Knowing the level of risk in the work environment.

Case Study

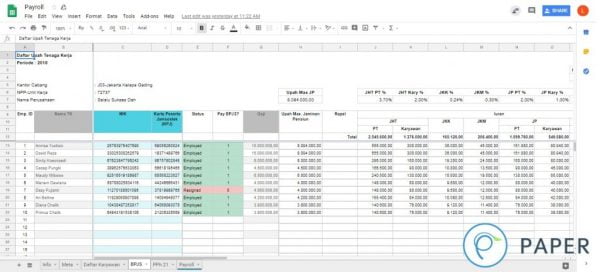

Example of BPJS – Paper.id

Sukses Selalu Dah. Ltd has 10 employees who have registered as Employment BPJS participants. From all of these names, I will take the example of two employees to study how to infer how Employment BPJS contributions, namely:

Annisa Yustisio: IDR 15,000,000

Primus Chalik: IDR 3,800,000.

The salary received by Annisa Yustisio and Primus Chalik has been determined by Sukses Selalu Baik.Ltd. Hence, how do you find out the four tuition fees at the Employment BPJS?

Annisa Yustisio Employment BPJS

- JKK fees: 0.54% x IDR 15,000,000 = IDR 81,000 (paid by the company)

- JKM fee: 0.30% x IDR 15,000,000 = IDR 45,000 (paid by the company)

- JHT contribution: 3.7% x IDR 15,000,000 = IDR 555,000 (paid by the company)

- * Contribution Fee: 2% x IDR 15,000,000 = IDR 300,0000 (paid by individuals)

- JP Fee: 2% x IDR 15,000,000 = IDR 300,000 (paid by the company)

- * JP Fee: 1% x IDR 15,000,000 = IDR 150,000 (paid by individuals)

Total payment:

- Paid by companies: 81,000 + 45,000 + 555,000 + 300,000 = IDR 981,000 every month

- Paid by individuals: 300,000 + 150,000 = IDR 450,000 every month

- Then, the payment of Annisa’s BPJS is: 981,000 + 450,000 = IDR 1,431,000 every month.

- Primus Chalik Employment BPJS

- JKK fees: 0.24% x IDR 3,800,000 = IDR 9,120 (paid by the company)

- JKM fee: 0.30% x IDR 3,800,000 = IDR 11,400 (paid by the company)

- JHT contribution: 3.7% x IDR 3,800,000 = IDR 140,600 (paid by the company)

- * Contribution Fee: 2% x IDR 3,800,000 = IDR 76,000 (paid by individuals)

- JP Fee: 2% x IDR 3,800,000 = IDR 76,000 (paid by the company)

- * JP Fee: 1% x IDR 3,800,000 = IDR 38,000 (paid by individuals)

Total Payments:

- Paid by companies: 9,120 + 11,400 + 140,600 + 76,000 = IDR 237,120 every month.

- Paid by individuals: 76,000 + 38,000 = IDR 114,000 every month.

- Therefore, the payment of Primus’s BPJS is: 237,120 + 114,000 = IDR 351,120 in one month

Thus, those are the ways to calculate Employment BPJS. If you have more questions about the above, please write in the comments column.

- Paper.id & HIPMI Sign MOU to Enhance Digitalization & Processes - October 2, 2022

- 4 Ways to Boost SMEs Success - August 16, 2022

- Paper.id & Blibli Collaborate to Streamline E-Commerce Invoice - July 25, 2022